Medicare Supplement Plans

Understanding Medicare Supplement Plans

If you have Original Medicare, you can use a Medicare Supplement insurance (Medigap) plan to help cover specific out-of-pocket costs that Parts A and B do not pay. This additional coverage can be tricky and expensive. To skip the struggles and get the best deals, our brokers are knowledgeable in everything related to Medicare Supplement plans. The policies that you can buy through us are A, B, F, G, and N.

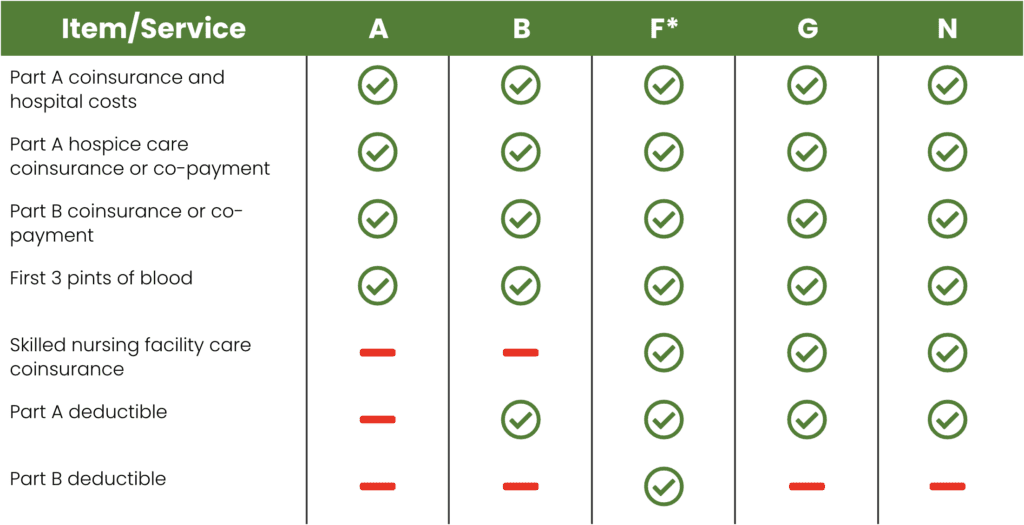

Medicare Supplement (Medigap) Plans Chart

Part A hospice care coinsurance or co-payment

Item/Service

A

B

F*

G

N

Part A coinsurance and hospital costs

Part A hospice care coinsurance or co-payment

Part B coinsurance or co-payment

First 3 pints of blood

Skilled nursing facility care coinsurance

Part A deductible

Part B deductible

* Plan F is not available to those who are newly eligible for Medicare, as of January 1, 2020.

Plans G and F offer a high deductible plan in some states.

Why Get Medicare Supplement Insurance?

- Pays what Medicare does not

- Freedom to travel — you’re covered anywhere in the U.S.

- Use any doctors and hospitals who accept Medicare

- Flexible plan options

- Your policy can’t be cancelled

With a variety of plans to choose from, you can compare costs and coverage for your needs and lifestyle.

Get the right coverage at the right price.

Medigap Plan A

Plan A is a good option when you need a little extra cost protection beyond what’s covered by Original Medicare.

Medigap Plan B

Get the same benefits as Plan A, plus coverage for the Medicare Part A deductible ($1,484 per benefit period in 2021).

Medigap Plan F

Plan F offers the most coverage and the lowest out-of-pocket costs for services covered by Medicare.*

Medigap Plan G

Plan G offers the same benefits as Plan F except for the Medicare Part B deductible. If you want the most coverage aftering paying this annual deductible, Plan G is a good fit.

Medigap Plan N

Plan N has become more popular in recent years. It comes with a lower monthly premium for the benefits provided, and the out-of-pocket costs are easy to foretell.

* Plan F is only available if you first became eligible for Medicare before January 1, 2020.

Should You Choose Medigap or Medicare Advantage? Questions to Consider

If you need help choosing the Medicare coverage that’s right for you, contact an agent for help. Your agent has a legal and ethical obligation to act in your best interest. When you meet with Oak Haven Insurance, we’ll take the time to get to know you and your health insurance needs.

To figure out what’s most important to you, we may ask questions such as:

- Do you prefer to pay out-of-pocket costs when you need care, with low or no monthly premium? Or, do you prefer to pay a fixed monthly premium with low or no out-of-pocket costs?

- Would you rather be able to choose any doctor or hospital that accepts Medicare, or, are you okay with choosing a doctor or hospital from a set network?

- Would you like dental and vision coverage included in your plan, or, if you want dental and vision coverage, will you buy them separately?

- If you’re away from home or traveling (in the U.S. only), do you want to be able to see any doctor or hospital that accepts Medicare? Or, are you okay with going to a provider from a set network?

By answering these questions, it allows us to make certain recommendations on the type of Medicare coverage that fits your situation. It may be a Medicare Supplement plan. It may be a Medicare Advantage plan. Either way, you’ll be in safe hands when you choose Oak Haven Insurance Agency.