Medical Savings Account

Find Out if a Medicare MSA Is Right for You

While Medicare covers many of your healthcare expenses after you turn 65, it doesn’t cover everything. You may qualify for a high-deductible plan called a Medicare medical savings account (MSA). These health insurance plans use a flexible savings account that the government funds every year.

There’s some confusion about who’s eligible for MSAs and how they work, but Oak Haven Insurance Agency is here to provide clarity.

Medicare MSA Plans Have Two Parts

High-Deductible

Health Plan

Medicare Savings

Account

What Is a Medicare MSA?

Medicare MSAs are available for those who have high-deductible, private health plans. They’re similar to employer-supported health savings accounts (HSAs), except MSAs are a type of Medicare Advantage (Part C) plan — sold by private insurance companies — that contract with banks to set up the savings accounts.

If you have an MSA, Medicare puts a certain amount of money into that account at the start of each year. The money that’s deposited is tax-exempt, and you can withdraw the money from your MSA, tax-free, as long as you use it for eligible healthcare expenses.

Once you’ve hit your annual deductible using the MSA, the rest of your Medicare-eligible healthcare costs are covered for the remainder of the year.

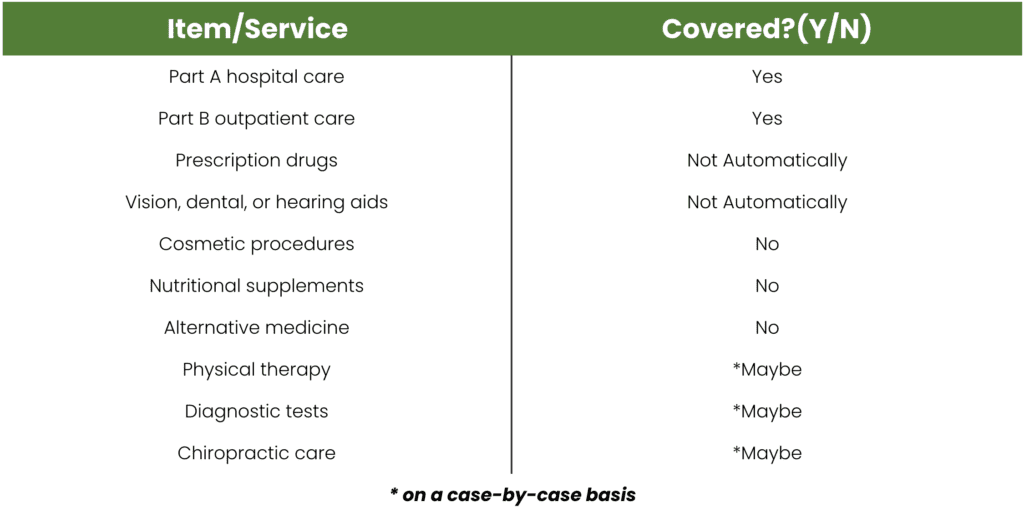

What a Medicare MSA Plan Covers

Once you meet your deductible, a Medicare MSA must cover all Original Medicare Services, including hospital care (Part A) and outpatient healthcare (Part B).

Some plans may offer additional benefits, including vision, dental, or hearing aids, for an extra cost.

An MSA will not automatically cover prescription drug coverage (Part D). You can buy a Part D plan separately, and the money you spend on prescription drugs can still come out of your MSA. However, copays on medications won’t count toward your deductible.

Note: Only Medicare-covered Part A and Part B services count toward your MSA deductible.

View the table below to see what’s covered:

Item/Service

Covered?(Y/N)

Part A hospital care

Yes

Part B outpatient care

Yes

Prescription drugs

Not Automatically

Vision, dental, or hearing aids

Not Automatically

Cosmetic procedures

No

Nutritional supplements

No

Alternative medicine

No

Physical therapy

*Maybe

Diagnostic tests

*Maybe

Chiropractic care

*Maybe

* on a case-by-case basis

Get the right coverage at the right price.

How Much Does a Medicare MSA Cost?

If you have a Medicare MSA plan, you’ll need to continue paying your Part B monthly premium of $148.50. You’ll also need to pay a premium to enroll in a separate Part D plan.

Once you receive your initial deposit, you can move the money from your MSA to a savings account that a different financial institution provides. That bank’s rules about minimum balances, transfer fees, or interest rates may apply.

You should also know that there are penalties and fees for withdrawing money for something other than approved health costs.

Who Is Eligible for a Medicare MSA?

In general, people with both Parts A and B can join a Medicare MSA Plan. If any of the following apply to you, you can’t join one:

- You qualify for Medicaid

- You’re in hospice care

- You have End-Stage Renal Disease (ESRD)

- You live outside the U.S. for half the year or more

- You already have health coverage that would cover all or some of your yearly deductible

When to Join a Medicare MSA Plan

You can enroll in a Medicare MSA during the Annual Election Period (AEP) between October 15 and December 7. You can also join a Medicare savings account when you FIRST sign up for Medicare Part B.

Is a Medicare MSA Right for You?

Before joining an MSA, you’ll want to ask these questions:

What will the deductible be? Plans with MSAs normally have a HIGH deductible.

What will the yearly deposit from Medicare be? Subtract the yearly deposit from the deductible amount and you can find out how much of the deductible is your responsibility — before Medicare will pay for your care.

For example, if the deductible is $5,000 and Medicare is contributing $1,000 to your MSA, you’ll be responsible for the leftover $4,000 out of pocket before your healthcare is covered.

A Medicare savings account could work if you’re spending tons of money on high premiums and would prefer to divvy up those costs toward a deductible. These plans cap your spending for the calendar year, so you have a clear picture of the maximum amount you might need to pay. In other words, an MSA could balance how much you spend on healthcare each year, which can provide valuable peace of mind.

The Bottom Line

Medicare MSAs are designed to help Medicare recipients with their deductible, and give them more control over their healthcare spending. MSAs also guarantee a substantial, tax-free deposit toward your deductible each year.

With that being said — MSA plans vary, so contact Oak Haven Insurance Agency to see if one is right for you.